Duration of engagment

Medium-Long (2-5 years; 2 years is the shortest duration for a multi-stakeholder partnership to show concrete results)

Cost

Multi-stakeholder platforms tend to require annual budgets in the $100-200K range

($)

Organization costs (e.g. travel, venue booking)

($$)

Third party to facilitate multi-stakeholder discussions

($$$)

Institution costs (e.g. staff, action plan implementation, data collection)

In the real world

Underwriting multi-stakeholder governance

A group of companies and foundations have provided funds that support the Coalition for Sustainable Livelihoods (CSL) initiative in Aceh and in North Sumatra, Indonesia. Funding has gone toward high-level coordination of the initiative, convening multi-stakeholder workshops that shape the direction of the initiative, and coordination of working groups that are building out the initiative’s components. Funding, technical support and guidance have come from Barry Callebaut, Mars Wrigley Confectionary, Mondelēz International, PepsiCo, Unilever, Walmart Foundation, Conservation International, Earthworm Foundation, IDH, The Livelihoods Fund, UNDP, and the Global Environment Facility. Corporate funding and technical support also underwrite some regency-level L/JIs convened within the provinces under the CSL umbrella. This helps Aceh Tamiang and Southern Aceh carry out landscape-level diagnoses of deforestation drivers, develop community alternative livelihoods, and build capacity for palm oil mills and plantations to implement NDPE commitments.

Funding implementation of a jurisdictional action plan

Several companies have committed financial support for Sabah, Malaysia’s Jurisdictional Certification Steering Committee (JCSC)– the multi-stakeholder body charged with achieving the state’s certification and forest conservation goals – and/or activities it oversees. HSBC funds enabled district-level HCV mapping and land use planning as a first step toward scaling these efforts state-wide. Unilever funds enable the JCSC’s secretariat to more effectively carry out its work streams. Several other companies are funding a conservation assurance index – to be developed by local government and research institutions – that will monitor progress toward the state’s goals each year by providing reliable and objective information about governance, environmental health, sustainable production, and social development.

Tea companies support landscape-scale conservation initiative

Unilever Tea and Finlays have committed annual funding to support an IDH initiative to conserve a highly threatened part of the Mau Forests Complex in southeastern Kenya, by providing economic benefit to local communities. The corporate funds, augmented by the Kenya Tea Development Agency and the Safaricom Foundation, help implement the initiative’s action agenda to plant more natives trees across a 250 ha landscape, intensify livestock grazing, and carry out surveillance against illegal activities impacting the forest.

Key points for companies

Engage with the government or other entity leading the L/JI to understand the specific funding needs. The kind and costs of these needs will depend on the initiative’s maturity, from outreach or convening efforts in early stages, to building consensus or developing strategies and action plans around a shared vision during middle phases, to operating expenses, hiring secretariat staff, implementing plans, monitoring data, or tracking progress as the initiative matures.

- Request a budget to better determine which categories of activity in the initiative need how much money and what other sources of funding are currently or potentially available.

Determine whether to provide unrestricted funds which the initiative allocates as needed, or funds for specific activities. Unrestricted funds help buffer unforeseen costs that can often arise and shift immediate priorities.

Hold initiative leads accountable to ensure funding is having the desired impact. Ask periodic progress reports (e.g. semi-annual) on how the money is spent, measured against the goals to which company finances are contributing. Review reports with an eye toward effectiveness and suggest to the initiative lead how they could improve.

Rather than go it alone, an individual business can better provide a portion of the funds, then seek complementary monetary or in-kind contributions from other companies, government agencies, large conservation NGOs, etc. Joint funding avoids any perception of disproportionate influence by any one entity and ensures that other stakeholders have “skin in the game” for the success of the initiative.

- If one or more companies provide early funding for an L/JI and are joined by other companies later on, all parties should agree on how the newcomers can equitably support later-stage needs so that they feel properly invested in the initiative’s success.

As the L/JI shifts from planning to implementation, the scale of funding required is likely to increase by orders of magnitude (10-100), depending on how ambitious and cross-sectoral the targets and activities are. At this stage, company support still matters, but it should identify other and more sustainable sources of financing so the initiative can achieve its landscape/jurisdictional goals. See also “Enhance sustainability-pegged financial flows”, “Help develop carbon offset programs”.

External conditions that improve likelihood of success

- There is adequate financial planning, management, and reporting capacity of the institution leading the landscape/jurisdictional initiative.

- Time frames for funding are consistent with company priorities and expectations for progress and results

- The planning phase can tap into funds from a diverse coalition of sources that includes companies, government agencies, conservation NGOs, and international donors

- There is real potential to generate additional, substantial, and sustainable funding during the implementation phase from commodity market premiums, carbon finance, and other sources

The business case for this intervention

- Ensuring a financially viable multi-stakeholder L/JI platform could multiply a company’s initial investment by leveraging 10x-100x additional funding through commodity and carbon markets.

- Companies that fund the multi-stakeholder platform lead by example and can encourage others to contribute.

- By highlighting its L/JI commitment, a company can increase brand value and enhance its social license to operate.

- Financial support can improve relationships with other L/JI stakeholders and clarify synergies between government priorities and private interests.

Duration of engagment

Short (6-12 months per capacity building intervention)

Cost

(No cost)

Advocacy on behalf of community representatives at meetings

($)

Support for community representatives to participate in meetings

($)

Costs of capacity building for community representatives and constituencies

($$)

Costs of community capacity baseline assessment

($$)

Incentives/compensation for the communities

In the real world

Motivating forest conservation through secure land tenure

Golden Agri-Resources (GAR), a large oil palm plantation operator, worked with stakeholders in Kapuas Hulu district in West Kalimantan, Indonesia to develop a land use plan that clearly delineates areas for conservation, livelihood activities, and development. The plan grew out of a critical independent review when the company’s earlier conservation efforts, carried out with unsatisfactory community engagement, sparked resistance by locals who considered ecological set-asides to be land grabs. This time, GAR tested a Participative Conservation Planning tool that incorporated community views into the plan by combining conservation mapping with participatory village mapping. The plan was ultimately approved by local government. During its negotiations with the government to get this plan approved, GAR worked to ensure that participating local communities receive land tenure security and access to loans from a state infrastructure fund.

Governing cocoa production from below

To advance sustainable cocoa production landscapes in Ghana, Touton formed a consortium with Ghana’s Forestry Commission, Tropenbos, and the Nature Conservation Research Centre (NCRC), leveraging these partners’ experience mobilizing communities and strengthening community-based natural resource governance. The consortium worked with local communities and their leaders to build governance structures on the Community Resource Management Area (CREMA) approach. CREMA strengthens existing community structures by developing landscape management plans, governance boards, and constitutions governing the landscapes. The overall effort connected communities with local government administrations to directly influence and tap into development plans for the entire jurisdiction.

Key points for companies

What companies do will depend on communities’ existing capacities. First, assess these capacities, and gaps, to understand what prevents more active community engagement in multi-stakeholder processes. Then consider the following range of actions, seeking effective and representative participation especially of women given their role in ensuring that development efforts endure:

Clearly articulate the value of community participation. Local communities may be discouraged or fatigued by years of promises from governments or companies that failed to generate tangible benefits. Provide clear incentives, status, and income opportunities to secure early and ongoing participation. Don’t over-promise, and be explicit about who would benefit (all members indirectly, or only those directly engaged). Clarify as well what the benefits will be (e.g. tenure security, higher crop yields or prices, improved genetic material, value-added processing, access to finance) and what participants must do, or risk, to earn them.

Organize communities for effective representation. Communities may be represented by legitimate and effective leadership through traditional local government and/or through women, youth, farmers, or small businesses constituencies. But they may also be marginalized. Rather than direct or engage deeply in an effort to enfranchise communities – with which companies may have competing or conflicting interests — companies can support their empowerment process by funding an independent third party to support community dialogue and organizing.

Build capacity for effective representation, consultation, decision making, and governance. Community representatives may need help understanding the roles, rules, tools, and steps in the landscape/jurisdictional planning process. Likewise, community members may need support to know what’s at stake and how to speak through and guide their representatives. A company could fund capacity building and/or provide seasoned staff to help enhance knowledge and skills.

- Capacity building is rarely a once-off. It is needed from the outset through planning and implementation, as new kinds of information, opportunities, and activities arise. Some opportunities and choices will present trade-offs within or between groups and require community dialogue to inform a response.

Disseminate landscape/jurisdictional information to communities. Provide regular information, in local languages, via trusted local media, about meetings with, topics in, and opportunities to engage with the multi-stakeholder body advancing an L/JI. When government policies change, companies can leverage these communication channels to raise awareness with communities about what is happening, and why it matters.

Help community representatives participate in the multi-stakeholder process. A company can offer financial support, compensating the most vulnerable community members (e.g. women, tribal or ethnic minorities) for any time away from their job or family that they invest in the landscape/jurisdictional process. It can also pay for live or written translation, to overcome language barriers to participation.

- Once in attendance, previously marginalized community representatives may often also need encouragement to speak openly and often. Companies can help create space in meetings for active participation by reserving them special time to voice their opinions, then ensure that what they say is respected. To that end, one helpful guide can be found in Tools and best practices for ensuring public participation in Environmental Impact Assessments.1

External conditions that improve likelihood of success

- A multi-stakeholder body represents the key actors in the landscape/jurisdiction

- Community organizations exist, and represent the interests of marginalized groups

- Communities see pre-identified and clearly communicated incentives to engage in the process

- Facilitators trained on public participation best practices are available to ensure a transparent and robust system for informed consent of vulnerable communities

- Communities and the company (or an intermediary NGO or CSO) enjoy an established and trusted relationship

- Parties have a strong understanding of socio-economic profiles of community groups and their involvement in land use issues

The business case for this intervention

- Active and effective community participation in landscape/jurisdictional planning and implementation often helps a company to achieve its stated sustainability/sourcing goals and targets.

- Catalyzing community participation in a multi-stakeholder process increases the likelihood that the solutions it advances will receive community buy-in and support, lowering risks of future conflicts.

- Direct support for community representation and participation can improve a company’s reputation and enhance its social license to operate.

- Direct engagement of communities in the multi-stakeholder process may accelerate solutions for land ownership, access to credit, and loans in countries where land tenure is not fully developed.

1 PACT has published a number of reports on public participation in EIAs, including one for the Mekong region as part of the Mekong Partnership for the Environment: https://www.pactworld.org/library/guidelines-public-participation-eia-mekong-region.

Share spatial data and land management plans with other stakeholders involved in landscape/jurisdictional land use planning and monitoringDuration of engagment

Short (6-12 months to gather data; 1 month to share it)

Cost

($)

Staff time to gather the data and attend workshops

($)

Staff time to share the data and address any resulting questions

($)

Organization costs to setup and participate in data sharing workshops

($$)

Legal agreements and NDAs surrounding the use and sharing of spatial data

In the real world

Sharing spatial analysis to address encroachment

In West Africa, Touton works with Rainforest Alliance to generate useful data about the farms from which it sources cocoa. Their collaboration runs analyses on the polygons that represent cocoa farms using geospatial and remote sensing data. These analyses determine the risk of encroachment in national parks and monitors real-time deforestation at the plot level. Developing this spatial data not only helps Touton address local deforestation in its own supply chain, but can also be shared with other relevant stakeholders to support land use planning and monitoring at larger scales.

A collaborative list for tracking palm oil origins

A growing list of companies, including traders like Wilmar and Musim Mas, and downstream buyers like Ferrero and Nestlé, have made publicly available the list of mills from which they or their suppliers source palm oil. In 2018, a group of non-profit organizations (World Resources Institute, Rainforest Alliance, Proforest, and Daemeter) aggregated these data for the first time in the form of the Universal Mill List (UML). The UML is a collection of palm oil mill locations around the world, which can be sorted by group, company, mill name, RSPO certification status, and unique “universal ID”. Companies aren’t the only ones contributing data to the UML. The RSPO, FoodReg, government entities, and supply chain researchers regularly add new spatial data, update information, correct mistakes, and weave in extensive records. Even smaller companies have provided tabular data on their websites regarding mill names, locations, and parent companies. The objective of the UML is to provide an accurate, comprehensive, common dataset of, by, and for the palm oil industry that can easily identify mills across various platforms and enhance reporting efforts.

Connecting the dots on sourcing beyond palm oil

A few companies, such as Unilever, have followed up this early data transparency push by publishing lists of their global suppliers for other commodities like cocoa, soy, paper and board, and tea. Cargill publishes a map that shows the name and location of the cooperative offices and buying stations in Côte d’Ivoire and Ghana from which it directly sources cocoa.

Key points for companies

Identify which company data other stakeholders could use to improve landscape/jurisdiction-level sustainability. Local stakeholders often lack a complete picture of land-related ecological, ownership, and use characteristics or dynamics, which impedes the ability to plan, execute, and monitor progress. Companies that possess these data or that have influence with those who do can fill important gaps in information.

- The data need not be proprietary. Companies can bring even relevant public information to the attention of other stakeholders unaware of it. For example, Global Forest Watch provides data on tree cover loss and instances of fire, which can be analyzed within any jurisdiction to determine where there may be deforestation hotspots or risk. Such data help inform land use planning decisions as well as monitoring and enforcement activities.

Data might be held by farm/concession managers if the company is a commodity producer, by the procurement or sustainability teams if the company is an upstream commodity buyer, or by producers and traders in the company’s supply chain that operate in the jurisdiction.

Relevant data could include:

- Boundaries of farms, ranches, forest management units, or concessions – including those managed by the company and by independent smallholders

- Coordinates of mills or other processing facilities

- Geological, water, or other biophysical data

- Maps of community lands and areas with important environmental attributes (e.g. High Conservation Value areas or High Carbon Stock areas)

- Management plans for land overseen by the company or by its suppliers

- Historical maps or other records of ground cover and land use that could help establish trends over time

- Non-competitive information on crop production, soil productivity, and/or conservation needs that could help identify good production practices

Data sharing can pose challenges both for local actors and to the companies that share. To mitigate these risks in advance, companies should:

- Follow national guidelines, particularly when sharing farm boundaries, and apply proper social and environmental safeguards to minimize impacts on local communities

- Draft agreements that define who can use the shared data, and how

- Aggregate contributions so that only consolidated data are made publicly available, with identifying information stripped out

- Limit sharing of the most sensitive or controversial data with only those government actors engaged in land use planning or enforcement (e.g. ministries of agriculture, forestry, environment, rural development), using non-disclosure agreements (NDAs) to ensure confidentiality of data that informs landscape/jurisdiction-level planning efforts.

Data should be shared with the multi-stakeholder body representing key actors in the landscape/jurisdiction to guide discussions about setting targets, planning land use, and implementing decisions (see “Co-design jurisdictional goals, key performance indicators (KPIs), and implementation strategies” and “Support development of a robust landscape/jurisdictional land use plan”). A robust conservation or restoration plan will take into account data about the relationship between priority conservation areas, production areas, and processing facilities. Likewise, access to these data will enable the government or other stakeholders to monitor implementation of landscape/jurisdictional action plans and progress toward achieving KPIs.

Share data in formats that match those used to develop or monitor progress toward meeting landscape/jurisdictional outcomes (ideally digital; sometimes printed maps or written descriptions are handy).

External conditions that improve likelihood of success

- Robust data management policies and metadata standards

The business case for this intervention

- Sharing data is an inexpensive way to show leadership while building trust with other stakeholders, advancing a culture of transparency, and encouraging others to share their own data. Companies are also in a position to determine who will gain internal or external access to confidential data, and for what purpose.

Duration of engagment

Medium-Long (2 years to develop and agree on sustainability protocols; 5 years to fully implement these protocols across the sector)

Cost

($)

Staff time/flights to participate in technical committee meetings

($)

Organization cost to set up and participate in in-person meetings (e.g. travel, venue booking)

($$)

Funding to convene the sector if it is not already convened

($$)

Pre-feasibility studies to identify technical solutions, potentially sub-contracted to external parties

($$)

Work to develop internal systems that follow agreed sustainability protocols

In the real world

Deforestation-free tequila production

The Regulatory Council of Tequila (CRT) is a Mexican industry association that promotes tequila’s quality, prestige, and sustainability. CRT developed a Sustainability Strategy for the Agave-Tequila Supply Chain, which aimed to reduce the industry’s carbon footprint, reliance on fossil fuels, and water use. To help implement this strategy, CRT and the Jalisco State Government (at COP25 in Madrid) agreed on specific measures to reduce the negative environmental impacts of agave cultivation and tequila production. Foremost, CRT would design and implement an agave-tequila Zero Deforestation Protocol and Certificate that integrates environmental criteria required by the state’s Secretary of Environment and Territorial Development (SEMADET) related to planning, zoning, and verification of new agave plantations as being deforestation-free. The Secretary is now drafting a reference map for monitoring compliance by agave producers with the deforestation-free protocol, which CRT will use to authorize future agave expansion only in unforested areas. Meanwhile, SEMADET will develop and adopt monitoring systems that report performance against deforestation in plantations.

Investing in clean Cameroonian cocoa

In two Cameroonian landscapes – Grand Mbam and Djourn-Mintom – and with facilitation from IDH and WWF, a group of cocoa sector companies is working to identify investible projects that will contribute to achieving landscape-level targets around sustainable production, forest protection, and community livelihoods. The companies include global businesses that source from Cameroon (e.g., Olam, Cargill, Barry Callebaut, Puratos), chocolate makers and brands (e.g., Mars, Natra), and local cocoa buying companies (e.g., Neoindustry, Ndongo Essomba). Detailed plans and investment opportunities were being discussed and developed at the time of writing.

Clean fuel for Cambodia’s textile industry

The public rarely traces deforestation to clothing. But H&M Group was concerned about unsustainable wood fuel used as a main source of thermal energy for garment factories. To address the issue, it launched a collaborative program in 2019 known as the Supply Chain And Landscape Approach in the Eastern Plains Landscape of Cambodia (SCALE). Following a multi-stakeholder workshop, other textile brands including Puma, Marks & Spencer, and Li-fung joined the initiative, and collaborated on a call to action to accelerate the use of alternative and sustainable energy across the landscape.

Joining forces to improve palm oil production

In two districts of Riau province, Indonesia, a group of palm oil producers and downstream buyers (Cargill, Danone, Golden Agri-Resources, Musim Mas, Neste, PepsiCo, and Unilever) have combined their resources to collaborate under the Siak Pelalawan Landscape Programme (SPLP). The companies signed an agreement that covers information sharing, funding allocation, monitoring, reporting, communication, and multi-stakeholder engagement. Within each district, SPLP is linking with multi-stakeholder processes (Green Siak in Siak and Forum for Sustainable Palm Oil (FoKSBI) in Pelalawan) to ensure alignment with local priorities. Program implementation began in 2020 and will run through 2024. Workstreams include: conservation and restoration of 5,000 ha; village-level support on sustainable production-protection models; development and implementation of district-wide traceability to plantations; transitioning mills to NDPE compliance; and support for multi-stakeholder platform development in both districts.

The danger of misalignment with government

In 2014, six of the largest palm oil producing companies in Indonesia (Asian Agri, Astra Agro Lestari, Cargill, Golden Agri-Resources, Musim Mas, and Wilmar) signed the Indonesian Palm Oil Pledge (IPOP), committing themselves to zero-deforestation. The pledge was not new; each company had already published its own No Deforestation, No Peat, No Exploitation (NDPE) commitment prior to signing. But it raised concerns by Indonesia’s government that IPOP might become a cartel, and a threat to smallholder development. Independent analysis suggested that the IPOP signatories organized in a way that the government perceived as a challenge to its sovereignty over producers, rule-making, and economic organization. In 2016, in response to official pushback, IPOP dissolved itself. The controversy and lack of high-level buy-in highlight the limits of corporate action and the critical importance of engaging government at various levels to achieve sustainable commodity production at scale. The IPOP experience served as a primary impetus for the development of jurisdictional initiatives in Indonesia.

Key points for companies

Effective L/JIs require strong government participation, but when they participate may vary. In some cases, it may be more practical for the private sector first to align interests and coordinate action within a landscape/jurisdiction, then later jointly approach the relevant government entities with a proposal for addressing environmental and social challenges across the region. In short, timing matters. When government is paralyzed or distracted by upcoming elections, or internal conflict between national and regional authorities interferes with regional collaboration, companies may make more early progress aligning priorities amongst themselves. What’s more, governments may be more willing to approve, support, and join coordinated efforts to address deforestation after they see strong, unified support from the private sector. In other instances, it may be more practical for companies to reverse that sequence. For example, where officials have convened a multi-stakeholder group to tackle landscape-level challenges, the private sector may collaborate to help shape and deliver on action plans that are already being negotiated.

Make a strategic choice between a single-sector or a cross-sector L/JI. The former may be easier to start; the latter easier to expand. Either can work if the conveners have a strategy for addressing the respective challenges and risks. When a single commodity is the dominant driver, but is shaped by other factors (e.g. logging, artisanal mining, subsistence farming), it makes sense to narrow focus on the commodity. Even then, engage actors from other sectors early and often, to strengthen their commitment as the L/JI develops.

If an association or discussion platform does not already exist within the landscape/jurisdiction, a company needs first to convene its sector. A (typically large) company might choose to take on the lead role as primary convener, or work in partnership with influential peers, or several could turn for help to outside facilitation.

- While finding ways to collaborate, always observe local anti-trust laws. Find creative ways for businesses to collaboratively set sustainability targets, co-develop policies and protocols, and agree on tools to meet shared targets – without affecting the ability of individual companies to compete on price or quality.

Align the sector on an ambitious sustainability vision and agree on rules of engagement that articulate shared expectations from the joint effort. Regardless of who initiates the convening, outside facilitation can foster this alignment.

If, as in the IPOP case above, there are concerns that the government might take issue with ambitions to exceed legally mandated levels of sustainability, the sector should engage the government at an early stage to seek out common ground.

To translate the vision into targets and actions, companies must first address differences in supply chain arrangements among brands and aggregators. One may operate through directly controlled plantations, another may rely on contracting with growers, still others may buy from local processors without farmer contracts. To accommodate these differences, align on the actors to target in the landscape/jurisdiction, and on how individual companies can change incentives for those actors.

With the sector aligned, companies should work with the relevant government authority (and/or credible NGOs) to develop sectoral protocols for sustainable production and trade. Doing so will define how companies spread out costs and responsibilities to create a “level playing field.” Though companies may face different costs to meet sustainability targets, early and open public-private collaboration will reduce the risk of certain companies trying to seek unfair advantages.

- In some geographies, multiple government entities might have overlapping authority over what a sector requires to implement its sustainability vision. If this is the case, companies must clarify what authorities each government entity holds, and ensure they are all on board with the agreed protocols. Where one government entity has lead authority, make sure it is positioned to champion the agreed protocol.

Where possible, devise a sector-managed system that provides the first level of oversight, which ensures that agreed protocols are followed internally. If not, companies should find a way to ensure all peers in the sector are at least sharing relevant data, and thus verifying that production and trade follow the protocols.

External conditions that improve likelihood of success

- A champion company within the sector, with strong and long-term ambition, leads the way.

- The sector is willing to collaborate on sustainability and drive toward a common agenda. Pre-existing industry collaboration at the global level is a plus (e.g. UNFCCC Fashion Charter, Cocoa and Forests Initiative).

- There is strong potential to develop trust between the sector and the relevant government entity.

- Key government entities are prepared to work through potential antitrust concerns, and willing to partner with the sector as a whole.

- The sector’s sustainability goals/strategy are compatible with those of the government.

The business case for this intervention

- Companies that try to implement their own ambitious sustainability protocols may be undercut by competitors who do not. By collaborating in the jurisdiction on a shared vision and framework, then engaging the government as a sector partner, all actors complete fairly, playing by the same rules on a level field.

- By approaching the government with a clear sectoral vision and strategy for achieving sustainability goals today, companies can preempt more costly and burdensome regulations imposed on their sector tomorrow.

- By collaborating closely with government agencies, companies can leverage government resources for implementing corporate sustainability efforts.

- By certifying production across an entire sector within a jurisdiction, companies build on economies of scale. This can obviate the need for separate mechanisms to monitor compliance at site level, helping suppliers reduce audit costs and audit fatigue.

- Designation of origin can be a valuable differentiator for consumers of certain commodities (e.g. tequila, coffee). By achieving sustainability goals across the entire sector within a jurisdiction, companies can associate their branded products from that jurisdiction as a way to distinguish them from less sustainable products originating elsewhere.

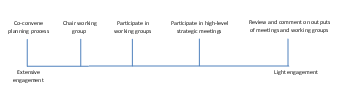

Duration of engagment

Medium (1-3 years)

Cost

($)

Participant

($$)

Convener/Coordinator, requiring significant investments of staff time and travel

($$$)

Funder of third-party implementers

($$$$)

Implementer of one or more steps articulated through the land use planning process

In the real world

Mapping priority conservation areas in Côte d’Ivoire

The French chocolate manufacturer Cémoi co-funded and coordinated implementation of a land use planning program in the regions of Mé, Agnéby-Tiassa, and Indénié-Djuablin. The company partnered with Côte d’Ivoire’s Coffee-Cacao Council (a government agency responsible for regulating and developing the coffee and cocoa sectors), other funders, and technical service providers to develop a land use reference map by identifying High Carbon Stock and High Conservation Value areas and to identify and validate key areas to conserve through a process that obtains communities’ free, prior, and informed consent. With this mapping, partners were able implement a range of protection, restoration, and sustainable cocoa cultivation activities aligned with a spatially explicit land use plan.

Conservation planning from below

In the Kapuas Hulu district of West Kalimantan, Indonesia, Golden Agri-Resources (GAR) manages three plantations covering 20,000 ha, which overlap 14 village boundaries. GAR had made a commitment to implement the High Carbon Stock Approach (HCSA) methodology for halting deforestation. That meant reserving certain portions of its plantations for conservation. The company had to ensure that local communities would not deforest lands it would set aside and leave intact, but early efforts did not adequately engage local communities, who viewed the set-asides as land grabs. Following an independent review of the social impacts of the company’s forest conservation policy, GAR piloted a Participative Conservation Planning tool with The Forest Trust, village leaders, government agencies, and local NGOs. The tool combined conservation mapping with participatory village mapping, and identified which area to protect, to manage for local livelihoods, and to develop for industrial agriculture. GAR then shared these maps with local governments to inform village-level spatial plans that clarified and secured broad public support for clear land use determinations. To scale mapping and spatial planning, GIZ, the High Conservation Value Resource Network and the district government are conducting a High Conservation Value and High Carbon Stock assessment throughout the entire district.

Villages help decree wildlife migration corridors

Bumitama Agri is a large Indonesian palm oil producer that suffered a period of tensions with local communities in its concession area. In response, the company worked with IDH and Aidenvironment to adopt village-level land use planning, empowering local stakeholders to influence decision making and reduce future risk of conflict. This participatory approach with community members sets out to map current land use for production, protection, and infrastructure/housing, as well as to propose improved land use zoning. All this is then brought to the local government for formal approval, through a village spatial plan decree. Since 2016, the project has established participatory land use maps for eight villages. The different village-level plans are aggregated into defined zones that protect wildlife migration corridors in West Kalimantan that connect the Gunung Tarak protected forest with the Sungai Putri peat swamp forest. Beyond social and ecological benefits, Bumitama saw a clear business case for undertaking this work.

Key points for companies

Government entities have lead authority over land use planning, yet companies play an important role (see Annex 2 in the PDF version of this Guidance for further details). They may catalyze the public process if plans are absent or need updating, and they may participate in a process that the government has already initiated. Specifically, companies can:

Facilitate participation by relevant stakeholders in the planning process where these stakeholders are receptive and where the company possesses sufficient influence and trust to invite their participation. A neutral, third-party facilitator is often best positioned to convene diverse local stakeholders, including those who may not trust companies or other actors, and can mitigate the power imbalance between various interests.

Support development of a land use reference map that is produced in an inclusive, participatory fashion. A company may take on this work directly or support it by funding consultants or NGOs to lead the technical effort, while also providing data and staff time to help review documents.

- A reference map helps planners grasp how different actors are using a jurisdiction’s land. Stakeholders can identify overlaps with priority conservation areas, anticipate and defuse potential conflicts, and find alignments among productive uses and users.

Contribute staff knowledge, data, and ecological training to help determine priority areas for conservation in the landscape/jurisdiction.

- The technical process of prioritization – often led by a government entity or a third party – applies tools that delineate which areas require protection, restoration, or specialized management to achieve conservation outcomes (including High Carbon Stock, High Conservation Value, and Key Biodiversity Area methodologies). It also assesses overlapping land ownership, usage rights, and other social factors.

- GAR’s experience shows how companies (or governments, for that matter) cannot undertake land use planning without consulting affected populations, even where the intent (e.g. preventing deforestation) is virtuous.

Negotiate the land use plan in good faith, aligning corporate sustainability ambitions with job creation and social equity (empower the voices of local communities, smallholders, and women in the negotiation), while minimizing production-protection trade-offs.

External conditions that improve likelihood of success

- Stakeholders in the L/JI are willing to engage in the land use planning process based on shared interests in improving conservation while meeting economic needs.

- Government actors with land use authority demonstrate both commitment and capacity to use the resulting plan as the basis for regulation and enforcement.

- Land use experts are available who can identify and map priority conservation areas, and then integrate economic, environmental, and community perspectives into the plan.

- Local communities and smallholders have enough time and organizational capacity to participate through trusted leaders and chosen representatives.

- Land tenure had been clearly defined, and there is either an absence of, or a pathway for addressing, any conflicting land use rights.

- There is participation, or at least buy-in, by a critical mass of companies whose operations have significant impacts on land, ensuring accurate information and adequate support for the land use priorities and plan that emerges.

The business case for this intervention

- By working with relevant stakeholders to generate a land use plan, a company reduces risk of conflict over misaligned objectives, avoids potential duplication of activities and investments, and clarifies the government’s expectations of what companies can do to ensure their actions comply with the law.

- By aligning with the government and local stakeholders on permitted land uses, a company reduces risk that (in)action by others will undermine its own sustainability goals and targets.

- By embedding methodologies like the High Carbon Stock Approach or High Conservation Value assessments into landscape/jurisdiction-level land use plans, a company:

- Avoids the need to undertake conservation planning whenever it wishes to expand production or sourcing within the landscape/jurisdiction.

- Helps address deforestation on community-controlled forests both inside and outside the boundaries of its own managed farms or those from which it sources.

Duration of engagment

Medium (1-3 years)

Cost

($-$$)

Staff time/flights to participate in meetings/provide comments to written materials

($)

Support for meeting costs or to fund participation by local stakeholders

($$-$$$)

Consultants to assist with initiative design and facilitation

In the real world

“Hotspot Intervention Areas” reduce emissions

The Ghana Cocoa Forest REDD+ Program (GCFRP) aims to reduce emissions driven by agriculture expansion, secure Ghana’s forests, and improve incomes and livelihood opportunities for farmers and forest users. The nation’s Forestry Commission has established a results-based planning and implementation framework through which the government, businesses, civil society, traditional authorities, and local communities can collaborate. The GCFRP has identified nine priority “Hotspot Intervention Areas” (HIA) in which local public and private stakeholders jointly design and implement scaled interventions.

a. In the Asunafo-Asutifi HIA, for example, 8 cocoa companies have been working with facilitation from Proforest and the World Cocoa Foundation on landscape-level assessments to support development of a management and investment plan.

b. Across other HIAs in Ghana’s larger Juabeso-Bia landscape, an initiative known as the Partnership for Productivity, Protection, and Resilience in Cocoa Landscapes (3PRCL) seeks to remediate deforestation caused by cocoa farming and other activities. Working with key stakeholders (cocoa producers, traders, processors, chocolatiers, logging companies, civil society, and government), the agro-industrial company, Touton, co-led a multi-year process to develop 3PRCL, creating a joint governance structure, goals, and strategies that would improve cocoa farmer yields and reduce deforestation. Through this process, stakeholders in each HIA created local natural resource management bodies, each empowered to register more than 5,000 farms illegally located in forest reserves, then help traditional and governmental authorities remediate the farms’ impacts over a 25-year period. The initiative has closely aligned its goals and strategies with the GCFRP and will test the standard and certification system for ‘climate-smart cocoa’ emerging under Ghana’s Cocoa Board.

Pursuing total statewide certification

In the state of Sabah, Malaysia, the Jurisdictional Certification Steering Committee (JCSC) oversees development and implementation of a work plan for achieving the goal of 100% statewide certification to the Roundtable on Sustainable Palm Oil (RSPO) standard. The JCSC is a multi-stakeholder group whose representatives — from government (5 departments), private sector (5 companies), and civil society (5 NGOs) — collaborated to develop a 5-year action plan to achieve Sabah’s certification. HSBC, Sime Darby, Wilmar, and two local companies participated in this process.

Crafting local sustainability metrics

Leaders of districts with membership in the Sustainable Districts Association (LTKL) have agreed to a set of credible targets and a reporting system aimed at boosting competitiveness and attracting new investment based on each district’s demonstrated sustainability. The districts worked with 31 companies through LTKL’s Partners Network to formulate the Kerangka Daya Saing Daerah (KDSD)/Regional Competitiveness Framework. KDSD integrates national policies and market-based frameworks (SDGs, Principles & Criteria of the RSPO, Terpercaya, Sustainable Landscapes Rating Tool, and Verified Sourcing Areas) for sustainable commodities production, ensuring coherence with subnational policy. Agribusinesses in each district are helping collect relevant data and translate the KDSD framework into locally specific targets, sustainable production plans, and means of verification. For instance, district-level translation of the framework in Siak, in Riau Province, is being done by a group of companies that includes Cargill, Danone, GAR, Musim Mas, Neste, PepsiCo, Unilever, RAPP, APP, and Chevron, with facilitation by Proforest and Daemeter.

Co-writing a road map to reach the “Green District”

In 2016, Indonesia’s Siak District in Riau Province set out with ambitions to become a “Green District.” A coalition of eight companies (Cargill, Danone, Musim Mas, Nestlé, PepsiCo, Golden Agri-Resources, Unilever, and L’Oréal) convened with facilitation from Daemeter and Proforest to help implement the district’s ambitious sustainability policies. These companies worked closely with the Siak government, the NGO coalition Sedagho Siak, and the community collective Kito Siak to develop a road map that would support the transformation toward sustainable palm oil across the district.

Key points for companies

To shape a L/JI, a government agency or NGO typically convenes a multi-stakeholder group to develop goals, KPIs, and implementation strategies (companies should see Annex 1 in the PDF version of this Guidance for further details of this process). The company’s role is to bring its perspective to discussions and help find solutions that boost productivity while minimizing negative environmental impacts and ensure respect for human rights. As illustrated here, a company’s level of engagement may vary based on its specific goals and level of investment (and/or risks) in each geography.

Companies should:

Clarify multi-stakeholder process goals and roles: who will participate, what they will contribute, and how the process it envisions will unfold.

Carefully consider whether all key stakeholders are represented (both those who can influence and achieve goals, and those most affected by their success or failure). If any appear to be “missing”, figure out how to recruit them, either from the start or at a later date if more appropriate.

During a multi-stakeholder process, communicate and negotiate in a constructive manner through an approach based on shared interests.

Identify information and resources to bring to the table and seek complementary inputs from other participants. For example, companies can help document and visualize data, yet ensure that subsequent planning and decision-making processes (using those data as a guide) are both inclusive and highly participatory.

Identify information and resources to bring to the table and seek complementary inputs from other participants. For example, companies can help document and visualize data, yet ensure that subsequent planning and decision-making processes (using those data as a guide) are both inclusive and highly participatory.

External conditions that improve likelihood of success

- Stakeholder interests are sufficiently complementary and/or aligned to develop shared goals and plans for the L/JI

- Local government is committed to progress toward sustainable practices

- A multi-stakeholder body represents the key actors in the landscape/jurisdiction

- That multi-stakeholder group has enough upfront funding to convene and start discussions

- There’s an adequate baseline for legal enforcement and relative lack of corruption

- Skilled facilitation (often by a neutral third party) is available to help build trust and find common ground

The business case for this intervention

- By aligning jurisdictional goals and KPIs with its own sustainability objectives, a company can leverage multi-stakeholder efforts to deliver outcomes it needs to deliver anyway (e.g. mapping of no-go areas, reduced illegality, verified conversion-free supply).

- Dialogue with relevant public agencies as part of the co-design process presents an opportunity to advocate and/or develop solutions to deforestation that minimize the regulatory burden and associated costs.

- Getting involved in the design process can provide a more transparent, affordable, and secure way for companies to voice opinions and indirectly shape local policy than by more directly advocating with government officials.

- Direct engagement with relevant agencies, CSOs, and communities can build relationships that prove valuable in other ways (e.g. being consulted on relevant decisions, familiarity with suppliers and their challenges/priorities).